Multiple successes with 20 winning deals at The Asset Triple A Country Awards 2020

This year, Crédit Agricole CIB actively participated in 20 winning transactions recognised by The Asset magazine, illustrating its wide range of expertise.

Anti-Covid-19, transition and Panda bonds, Leverage Buy Out financing (LBO), sustainability financing… This year, Crédit Agricole CIB actively participated in 20 winning transactions recognised by The Asset Will open in a new tab magazine, illustrating its wide range of expertise as Global Coordinator, Lead Manager, Bookrunner, Lead Underwriter, Lender, Dealer-Manager as well as Sustainability and Green Structuring and Financial Adviser.

Anti-Covid-19, transition and Panda bonds, Leverage Buy Out financing (LBO), sustainability financing… This year, Crédit Agricole CIB actively participated in 20 winning transactions recognised by The Asset Will open in a new tab magazine, illustrating its wide range of expertise as Global Coordinator, Lead Manager, Bookrunner, Lead Underwriter, Lender, Dealer-Manager as well as Sustainability and Green Structuring and Financial Adviser.

The Asset's annual Triple A (Asset Asian Awards) recognition represents the industry's most prestigious awards for banking, finance, treasury and capital markets thanks to the widest reach among Asian issuers and global institutional investors of this financial magazine.

The 20 winning deals, including numerous emblematic environmentally and socially responsible transactions, highlight Crédit Agricole CIB strong determination to build a more sustainable banking and economy in the Asia-Pacific region.

China Onshore – Best bank capital bond

Crédit Agricole S.A. 3 billion yuan TLAC Panda bond

First Panda bond by a European bank and first Total Loss-Absorbing Capacity (TLAC) Panda bond. Full story here Will open in a new tab .

Our role: Lead Underwriter, Bookrunner and Financial Adviser

China Offshore – Best sovereign bond

Ministry of Finance €4 billion multi-tranche senior bond

China’s first euro sovereign bond issuance after 15 years and the 20-year tranche marks the euro-denominated senior bond with the longest tenor from a Chinese issuer. Full story here Will open in a new tab .

Our role: Bookrunner and Lead Manager

Taiwan – Best sustainability financing

Far Eastern New Century Corporation NT$3 billion sustainability-linked facilities

First sustainability-linked commercial paper programme issued in Asia-Pacific. Full story here Will open in a new tab .

Our role: Sustainability Structuring Bank and Lender

Singapore – Best green bond

Vena Energy Capital US$325 million green bond

Client’s debut bond and it represents the first ever corporate USD green bond from a Singapore-headquartered company. Full story here Will open in a new tab .

Our role: Green Structuring Adviser, Global Coordinator, Bookrunner and Lead Manager

China – Best anti Covid-19 deal

Asian Infrastructure Investment Bank 3 billion yuan anti Covid-19 bond

Inaugural AIIB Panda bond response to the pandemic. AIIB approved a 2,485 million yuan loan to upgrade public health infrastructure and emergency equipment and supplies.

Our role: Financial adviser on sustainability

China Offshore – Best social bond

Bank of China (Macau) HK$4 billion and MOP1 billion SME-themed social bond

Issued in Feb, the first social bond with an explicit Covid-19 theme and first offshore social bond from a Chinese issuer.

Our role: Bookrunner and Lead Manager

China Offshore – Best sustainability bond

China Merchants Bank US$700 million dual-tranche sustainability bond

Support sustainable city development through public medical infrastructure and clean transportation.

Our role: Sustainability structuring agent, Global coordinator, Bookrunner

China Offshore – Best quasi-sovereign bond

China Development Bank £1 billion fixed rate senior unsecured bond

Bank’s first sterling bond issuance and establish a sterling benchmark for all Chinese and SSA issuers.

Our role: Bookrunner and Lead Manager

China Offshore – Best corporate bond

China National Travel Service Group Corporation US$900 million dual-tranche fixed rate notes

First bond transaction launched by a Chinese central state-owned enterprise since the primary market became muted in March.

Our role: Bookrunner and Lead Manager

China Offshore – Best corporate hybrid

China National Chemical Corporation US$3 billion equivalent five-tranche dual currency bond

First time for a Chinese company to issue simultaneously with such a variety of product offerings across different currency, tenor and type.

Our role: Global Coordinator, Bookrunner and Lead Manager

Hong Kong – Best green bond

MTR Corporation US$1.2 billion green bond

MTR’s first green bond issuance under its newly-established sustainable finance framework and the largest single tranche green bond for corporates in Asia-Pacific.

Our role: Bookrunner and Lead Manager

Hong Kong – Best energy transition bond

Castle Peak Power Company US$350 million senior fixed rate bond

Tightest 10-year re-offer yield of a HK issuer in 2020 at the time of the issuance.

Our role: Bookrunner and Lead Manager

Hong Kong – Best bank capital bond

Bank of East Asia US$600 million Basel III-compliant tier 2 subordinated notes

First USD tier 2 issuance globally since the Covid-19 and first Hong Kong bank issuance in 2020.

Our role: Lead Manager

South Korea – Best sustainability bond – Financial institution

Kookmin Bank €500 million sustainability covered bond

First euro-denominated covered bond printed by a Korean commercial bank and first sustainability-labeled covered bond issued out of Asia.

Our role: Bookrunner and Lead Manager

South Korea – Best green bond

Shinhan Bank €500 million green bond

Client’s first green bond denominated in euro and it achieved a competitive pricing to its USD curve despite being a new issuer in the euro bond market.

Our role: Bookrunner and Lead Manager

South Korea – Best corporate bond

Korea Telecom Corporation US$400 million senior notes

Lowest coupon + spread among Korean corporates since the 2008 global financial crisis.

Our role: Bookrunner and Lead Manager

South Korea – Best bank capital bond

Woori Bank US$550 million additional tier 1 perpetual notes

Lowest USD additional tier 1 (AT1) coupon by a Korean commercial bank.

Our role: Bookrunner

India – Best LBO

Baring Private Equity Asia US$600 million leverage buyout financing for Hexaware Technologies

Largest leveraged loan financing from India.

Our role: Mandated Lead Arranger

Indonesia – Best corporate bond

Tower Bersama Infrastructure US$350 million unrated senior notes

Lowest ever coupon for a five-year non-SOE corporate deal out of Indonesia.

Our role: Global Coordinator, Bookrunner and Lead Manager

Indonesia – Best liability management

Pertamina US$1.45 billion dual-tranche senior notes and any-and-all tender offer

First ever 40-year USD bond issuance out of Indonesia.

Our role: Bookrunner, Lead Manager and Dealer-Manager

- Awards & RankingsArticle07/01/2026

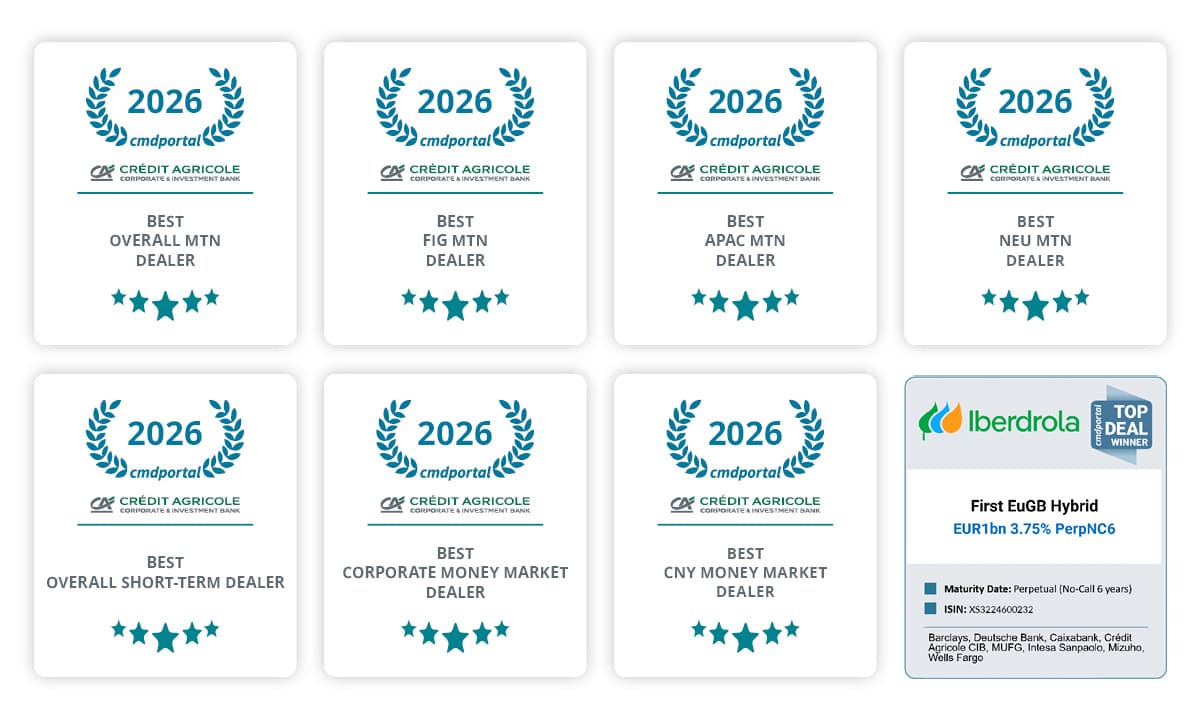

Collaborative Market Data Awards 2026: our Bank snapped up a total of 8 awards (again!)

- Green financeArticle18/12/2025

Crédit Agricole CIB was named Sustainable Finance House of the Year for both EMEA and APAC at the 2025 IFR Awards

- Awards & RankingsArticle08/12/2025

Korea franchise recognised for excellence in end-to-end client service in capital markets