Our climate commitments

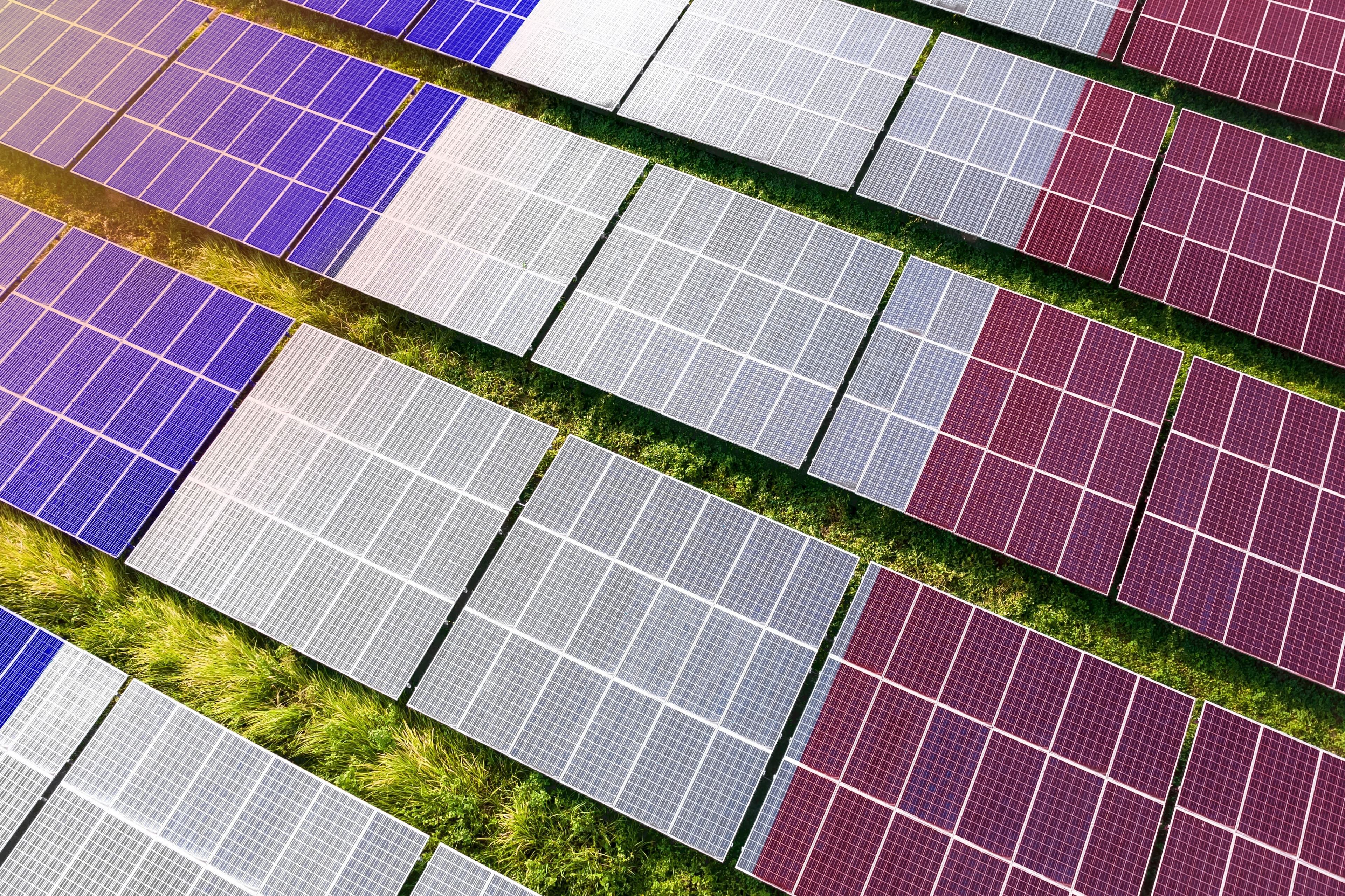

To limit the exploitation of fossil resources in order to achieve the objective of limiting global warming to 2°C by the end of the 21st century, the Crédit Agricole S.A. Group announced in May 2015 its decision to stop financing coal mining and hydrocarbon extraction projects in the Arctic in 2017 and adopted a climate strategy in June 2019 in line with the Paris Agreement.

In 2022, Crédit Agricole S.A. set 2030 targets for five sectors in line with the Net Zero Banking Alliance*:

- Oil & Gas,

- Energy,

- Automotive,

- Commercial Real Estate

- and Cement.

In a second phase, in 2023, the Crédit Agricole Group announced targets for five other sectors:

- Shipping,

- Aviation,

- Steel,

- Housing,

- Agriculture.

These ambitious commitments cover ten sectors that account for more than 75% of global greenhouse gas emissions and around 60% of the Crédit Agricole Group's exposure. The Group has also committed to reducing its own direct carbon footprint by 50% by 2030.

Crédit Agricole CIB has made a significant contribution to the work of the Crédit Agricole Group and has also reinforced its commitment to reduce its exposure to oil extraction and production to 25% between 2020 and 2025 (versus 20%).

Crédit Agricole CIB contributes to 8 out of 10 sectors in the Crédit Agricole S.A. Group's Net Zero commitments

1. OEMS: Original Equipment Manufacturers

2. Based on the fixed system boundaries perimeter defined by the Sustainable STEEL Principle

The scientific baseline scenario is the IEA NZE 2050 scenario for the Oil & Gas, Power Generation, Automotive and Cement sectors. For the commercial real estate sector, the baseline scenario is the 2021 CRREM (Carbon Risk Real Estate) scenario of 1.5 °C.

(1) taking into account scope 1 and 2 emissions of all counterparties and scope 3 emissions of upstream players, on our balance sheet exposure.

(2) scope 1 emissions from electricity producers; on- and off-balance sheet exposures taken into account for the reference base.

(3) scope 3 tank-to-wheel emissions from manufacturers and scope 1 end-user emissions, excluding heavy vehicles. On- and off- balance sheet exposure taken into account for the reference base.

(4) scopes 1 and 2 taking into account the use of the building, excluding construction. On- and off-balance sheet exposure taken into account for the reference base.

(5) gross CO2 emissions from scopes 1 and 2. On- and off-balance sheet exposure taken into account for the reference base.

To find out more...OUR OTHER TOPICS

Equator principles

Our CSR policy

CA Group and Crédit Agricole CIB frameworks & reporting