Crédit Agricole CIB sells a 4.9% stake in Banque Saudi Fransi

Crédit Agricole CIB sells a 4.9% stake in Banque Saudi Fransi to a Ripplewood led consortium.

Today, Crédit Agricole CIB announces the sale of a 4.9% equity stake in Banque Saudi Fransi (BSF) at a price of 31.50 Saudi Riyals per share, for a total consideration of approximately 1.86 billion Saudi Riyals, equivalent to approximately 440 million euros.

- 3.0% equity stake is being sold to RAM Holdings I Ltd, an investment vehicle controlled by Ripplewood Advisors LLC (“Ripplewood”), the US based investment holding company

- 1.9% equity stake is being sold to Riyadh-based Olayan Saudi Investment Company

Crédit Agricole CIB is thereby reducing its shareholding in BSF to 10.0%. Completion of the sale transactions is expected within the coming weeks subject, notably, to regulatory approvals.

As part of the sale, Ripplewood is also being granted the right to acquire, from Crédit Agricole CIB, an additional equity stake of 6.0% in BSF, such right being exercisable before end of December 2019, at a price of 30.00 Saudi Riyals per share, for a total consideration of approximately 2.17 billion Saudi Riyals, which is approximately 510 million euros (“Warrant”).

For Crédit Agricole, which has been active in Saudi Arabia since 1949 and associated with BSF since its creation in 1977,supporting its successful and profitable growth over several decades, this disposal is aligned with its strategy to reduce the weight of its non-controlling stakes.

The Warrant will generate an accounting loss of circa 100 million euros, depending of BSF share price at the time of issuance. The value of the Warrant will be adjusted quarterly up to its maturity date on a mark to market basis. These adjustments will be offset by the evolution of the value of the underlying equity stake, accounted through reserves according to IFRS 9. In case the Warrant is not exercised, then the initial accounting loss will be reversed through the profit and loss account.

Assuming both sales are completed and Ripplewood exercises the right to acquire, from Crédit Agricole CIB, the additional equity stake of 6.0%, the disposal of the 10.9% stake in BSF will have a positive effect in excess of 15 basis points on the fully-loaded CET1 ratio of Crédit Agricole S.A. and of over 10 basis points on the fully-loaded CET1 ratio of Crédit Agricole Group compared to the situation as of 31.12.2018, being understood that the abovementioned potential accounting losses are included in the computation of those effects.

Speaking on Crédit Agricole’s commitment to Saudi Arabia, Jacques Ripoll, Chief Executive Officer of Crédit Agricole CIB stated: “Crédit Agricole CIB remains highly confident in Saudi Arabia’s economic perspectives, in the wake of Vision 2030, and plans to further develop its direct presence and extend its activities in the country”

FindThe latest related news

- Client successesPress Release18/11/2022

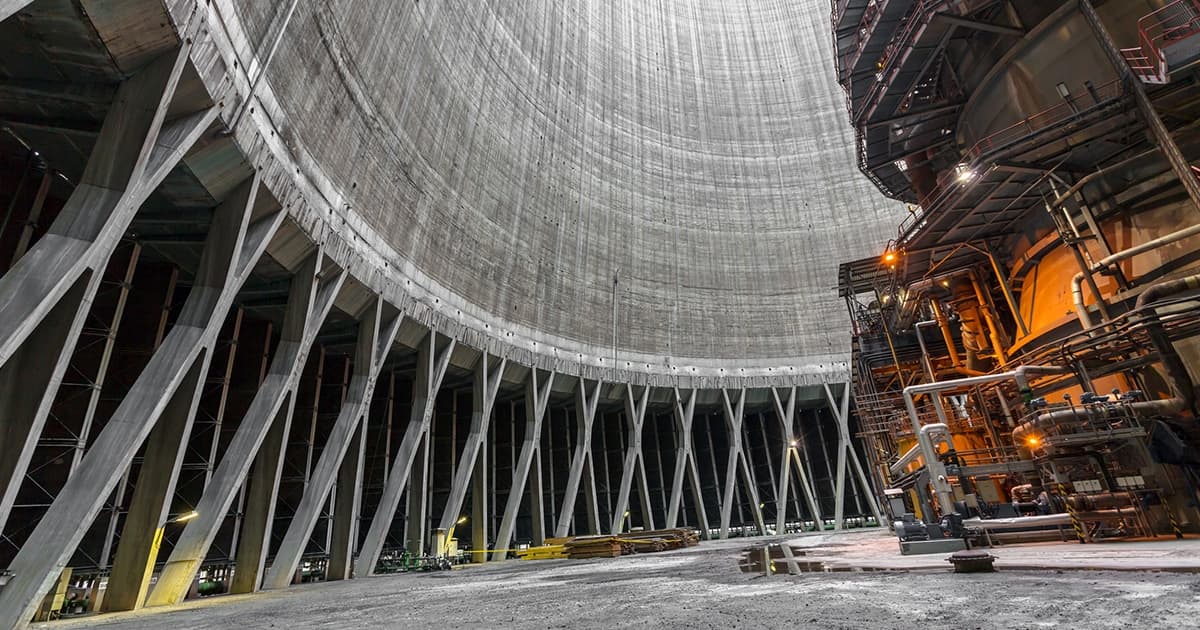

EDF and Crédit Agricole CIB sign a financing agreement dedicated to the maintenance of French nuclear power plants

- Client successesPress Release21/04/2022

CACEIS and Crédit Agricole CIB provide equity bridge financing to Antin for NextGen infrastructure fund

- Client successesPress Release11/01/2022

Crédit Agricole CIB supports Veepee through a Sustainability-linked Syndicated financing