Green, social & sustainability bonds

As a leader in sustainable finance, we are committed to working with our clients and partners to promote a more sustainable economy.

We help clients around the world to raise sustainable finance through the issuance of ESG bonds. These include green bonds, social bonds, sustainable bonds and bonds linked to sustainability criteria.

Crédit Agricole CIBA pioneer in Green, Social, and Sustainability Bonds

Since 2012, Crédit Agricole CIB has been a world leader in the structuring and placing of green, social and sustainability bonds.

The Sustainable Investment Banking team has played a leading role in the creation and development of this market and continues to promote its main innovations. Crédit Agricole CIB was part of the initial consortium of banks that developed the ICMA Green Bond Principles, which have now become the market standard for transparency and integrity among issuers. The bank is also member of the Green Bond Principles Executive Committee

Crédit Agricole CIB is active on a wide range of products: Green, Social, and Sustainability Bonds, as well as Sustainability Linked Bonds.

Our Green, Social, and Sustainability Bonds Offering

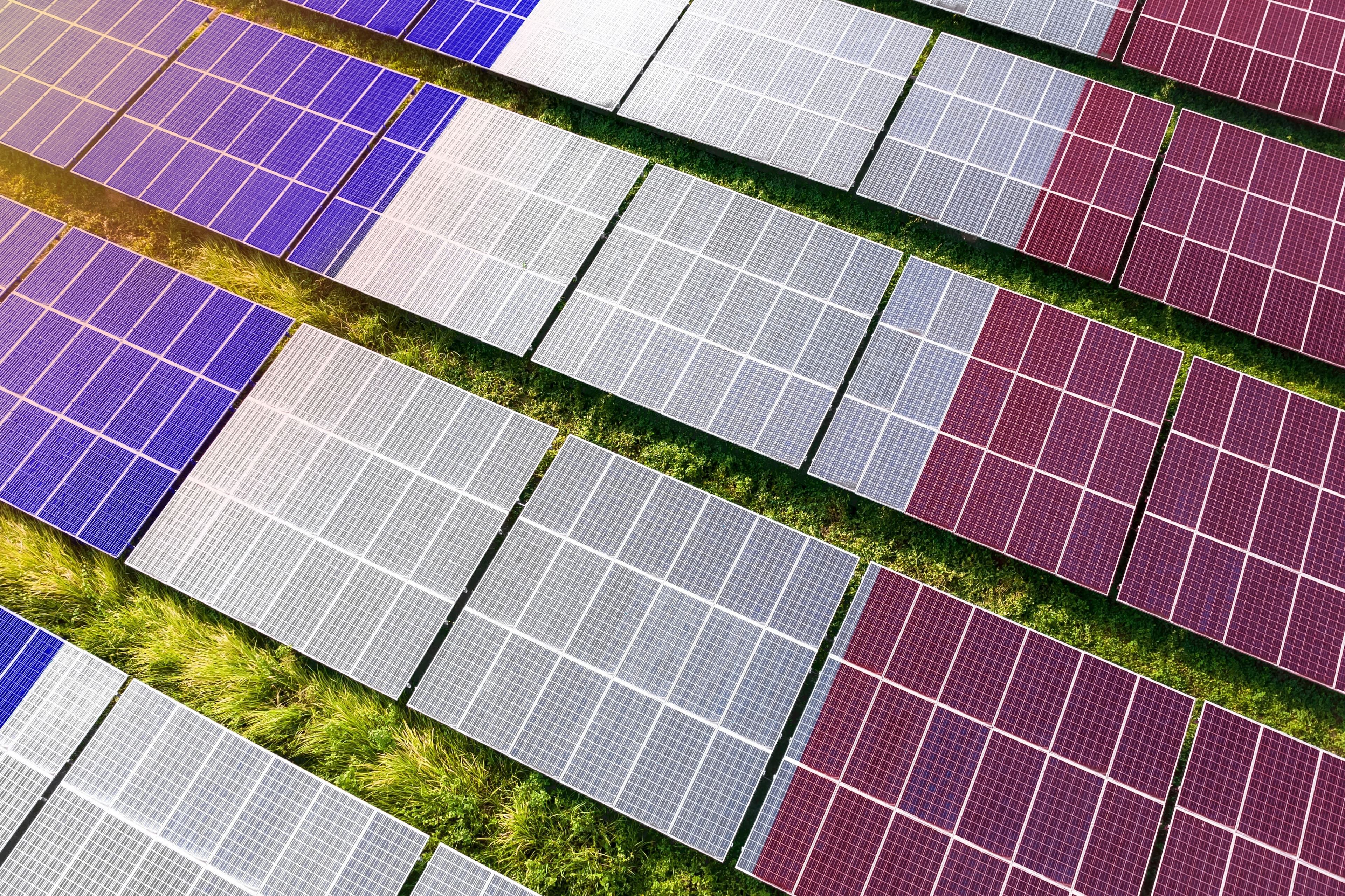

- A Green Use of Proceeds Bond is a debt instrument designed to raise funds to finance projects with a positive environmental impact, such as renewable energy infrastructure.

- A Social Use of Proceeds Bond is a debt instrument designed to raise funds to finance projects with a positive social impact, such as affordable housing or healthcare facilities.

- A Sustainability Use of Proceeds Bond combines the financing of green and social projects.

- A Sustainability Linked Bond is a performance-based debt instrument linked to specific Key Performance Indicators (KPIs) which define sustainability performance targets for the issuer, such as emission reduction objectives. Depending on the achievement of these targets, certain characteristics of the bond, such as the coupon rate, may be adjusted (e.g. step up or step down). Unlike a use of proceeds bond, the funds raised are not restricted to green or social projects, but may be used to finance general corporate expenditure.

Crédit Agricole CIB'sAwards and Recognition

Building on its success, in 2022 Crédit Agricole CIB was ranked first for EUR-denominated Green Social and Sustainability Bonds and third across all currencies (source: Bloomberg).

Crédit Agricole CIB’s leadership is recognized by the market with:

- Bank for Sustainability 2024 and APAC ESG Financing House 2024 by IFR

- Best Bank for Sustainable Finance Western Europe by the Euromoney Awards for Excellence 2024

- Sustainable FIG Financing House and Sustainable SSA Financing House by the Banker Investment Banking Awards 2024

- The Global Capital Bond Awards of most impressive bank for Financial Institutions (FI), Sovereigns Supranationals and Agencies (SSA) & Corporates ESG Capital Markets in 2023.

- The EMEA ESG financing house of the year in 2022 by IFR

To find out more...OUR OTHER TOPICS

Debt Capital Markets

Securitisation

Global Markets Research