Dual pressures on cash flow trigger optimisation to fund energy transition

Our experts Julien Tizorin and Ugur Bitiren share their insights on ccash flow optimisation to fund energy transition in an article published in Global Trade Review (GTR).

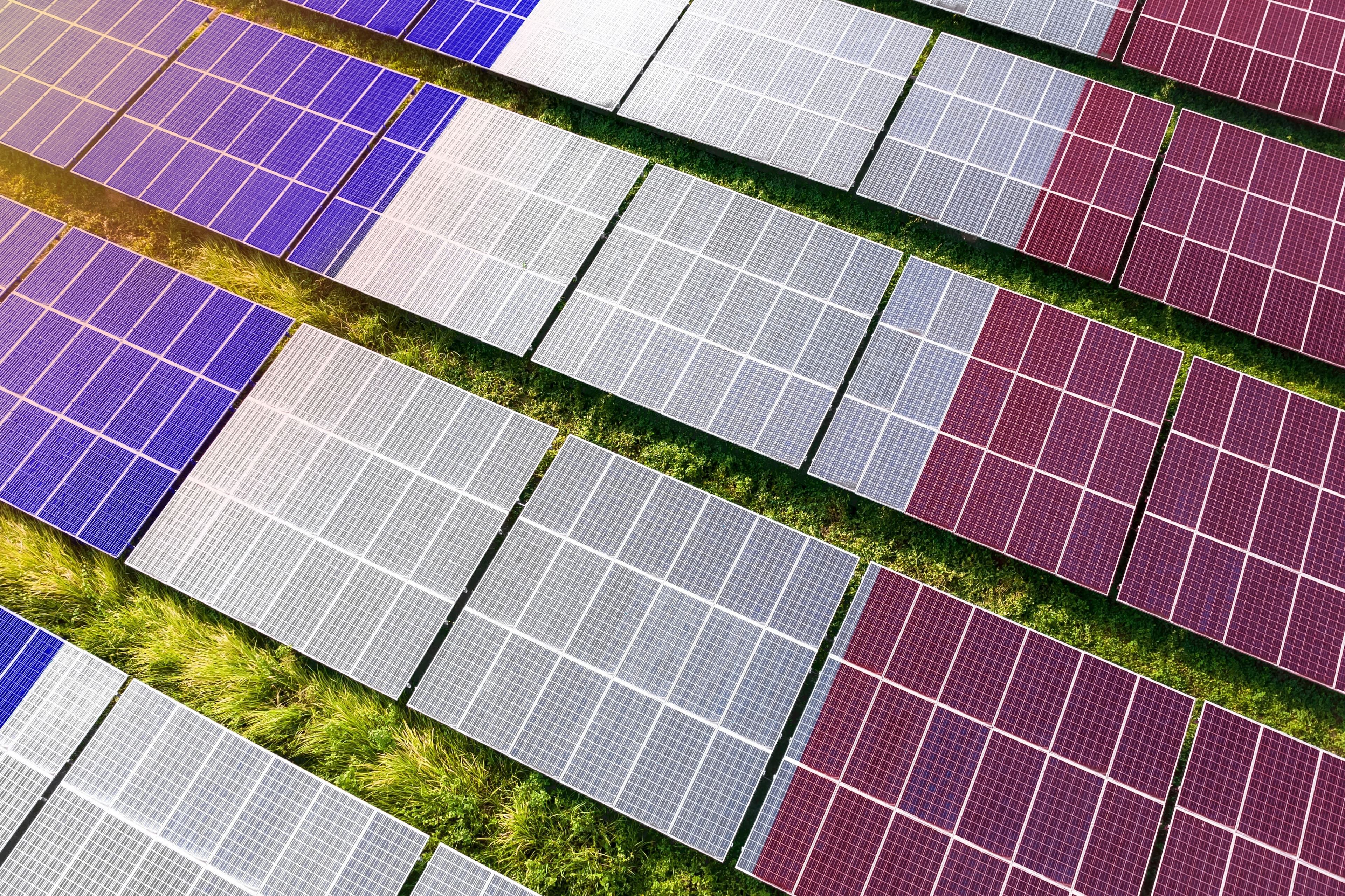

As investments in renewable energy rise, companies are facing cash flow challenges both on the outflow side (related to investments) and the inflow side (due to longer revenue cycles).

In response, Crédit Agricole CIB has implemented innovative solutions for financing capex, monetising receivables and managing cash, helping businesses maintain the economic viability of their energy transition projects.

In an article published in Global Trade Review (GTR) our experts Julien Tizorin, Head of Power & New Energy Coverage for North America, and Ugur Bitiren, Global Head of cash flow advisory at Crédit Agricole CIB, share their views on how cash flow pressures, coupled with the macro-economic environment, are driving firms globally to optimise their cash flows to fund the energy transition.

Discover key strategies to counter cash flow pressures and ensure optimal funding for the energy transition in the full article from Global Trade Review by clicking below.

- Client successesArticle19/02/2026

Crédit Agricole CIB supports GreenYellow in the deployment of a large portfolio of photovoltaic projects in France

- Client successesArticle12/02/2026

Crédit Agricole CIB supports the first digital inclusion bond for SMFG

- Green financeArticle09/02/2026

A new tool for understanding biodiversity risks