Crédit Agricole CIB recognised as EMEA ESG Financing House of the Year 2022

The IFR Awards are among the most highly regarded in the banking and capital markets industry.

EMEA ESG Financing House

“EMEA remained the biggest global market for sustainable finance in 2022 despite the turbulence sparked by the war in Ukraine. For a faultless performance across the region’s ESG-labelled markets in a challenging year, Credit Agricole CIB is IFR’s EMEA ESG Financing House of the Year.” IFR commented on its awards write-up which you can view here.

This is the seventh year that Crédit Agricole CIB is recognised, an exceptional result in a competitive market. We continue to be strongly engaged in developing the products and services to support our clients and enable sustainable change.

|

|

"Being the ESG Financing House of the Year in Europe and MEA is like winning the Champion’s League of sustainable finance. It can’t be achieved without first-class teams with top-notch dedication and unique team spirit. We are very proud of this award and thank our clients for their renewed trust." Tanguy Claquin, Global Head of Sustainability, Crédit Agricole CIB |

Involvement in our clients' winning transactions

We are also very proud to have supported our clients in the following winning categories:

- Sustainable Bond: Chile’s USD2bn sustainability-linked bond, on which Crédit Agricole CIB acted as Lead Manager. Read the write-up here.

- Emerging EMEA Bond: Public Investment Fund’s USD3bn triple-tranche green bond, on which we acted as green structuring adviser. Read the write-up here.

- Latin America Bond: Uruguay’s USD1.5bn sustainability-linked bond, for which we were Joint Bookrunner. Read the write-up here

- Asia Bond: Reliance Industries’ USD4bn triple-tranche bond, on which we acted as Joint Bookrunners. Read the write-up here.

- Latin America Loan: Phoenix Tower International’s USD2bn loan, om which we acted as a Mandated Lead Arranger. Read the write up here.

- EMEA IPO: Porsche’s EUR 9.08bn IPO, on which we acted as a Co-Lead Manager. Read the write-up here.

At the FR Asia Awards:

- Investment Grade Bond: Reliance Industries’ US$4bn triple-tranche bond. Read the write-up here.

- ESG Loan: Intellihub’s debut green loan of A$1.45bn-equivalent (US$1.06bn). Read the write-up here.

- Reminbi Bond: Hainan’s Rmb5bn three-tranche ESG Dim Sum transaction. Read the write-up here Will open in a new tab .

|

|

“These awards are a recognition of the quality of the work done by our teams in the DCM sector platform globally. A big thank you to our clients for giving us the opportunity to work with them on these iconic transactions." Atul Sodhi, Global Head of Debt Capital Markets, Crédit Agricole CIB |

- Green financePress Release08/01/2026

Sustainable outlook for 2026 - A maturing ESG fixed income market moving towards resilience

- Awards & RankingsArticle07/01/2026

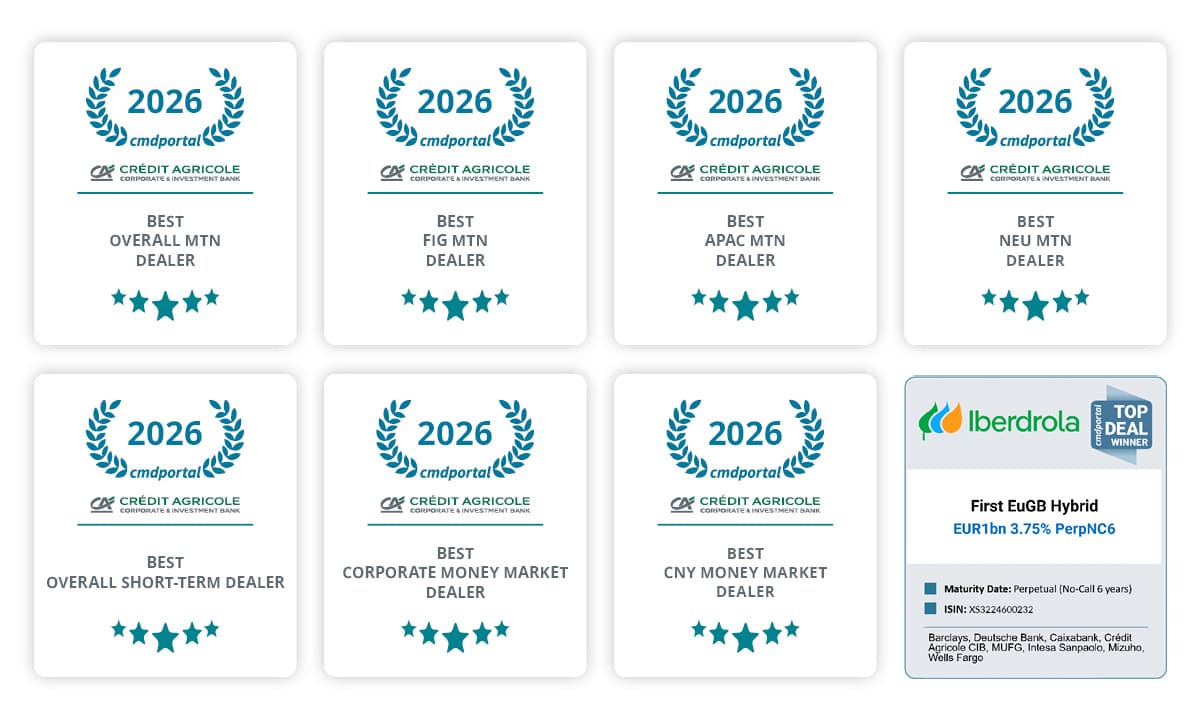

Collaborative Market Data Awards 2026: our Bank snapped up a total of 8 awards (again!)

- Green financeArticle18/12/2025

Crédit Agricole CIB was named Sustainable Finance House of the Year for both EMEA and APAC at the 2025 IFR Awards