Crédit Agricole GROUP

Crédit Agricole Group includes Crédit Agricole S.A., as well as all of the Regional Banks and local Banks and their subsidiaries.

FLOAT

- 29.6%INSTITUTIONAL INVESTORS

- 7%INDIVIDUAL SHAREHOLDERS

- 6%EMPLOYEE SHARE OWNERSHIP PLANS (ESOP)

- NS (1)TREASURY SHARES

HOLDING43.2%

REGIONAL BANKS

11.5MMUTUAL SHAREHOLDERS

who hold mutual shares in:

2,401

LOCAL BANKS

![]()

39

REGIONAL BANKS

jointly holding the majority of Crédit Agricole S.A.’s share capital through SAS Rue La Boétie(2)

HOLDING56.8% (3)

Crédit Agricole S.A.

Asset gathering and insurance:

- Indosuez Wealth Management

- Crédit Agricole Assurances

- Amundi Groupe Crédit Agricole

Retail Banking (4):

- Crédit Agricole - Pologne, Ukraine, Egypte,

- Crédit Agricole - Italie

- LCL Groupe Crédit Agricole

Specialised Financial Services:

- Crédit Agricole Consumer Finance

- Crédit Agricole Leasing & Factoring

Large Customers:

- Crédit Agricole Corporate & Investment Bank

- Caceis Investor Services

Specialised activities and subsidiaries:

- Crédit Agricole Group Infrastructure Platform

- Crédit Agricole Capital Investissement & Finance

- IDIA Capital Investissement

- Crédit Agricole Payment services

- Crédit Agricole Immobilier

- BforBank

- Uni_médias

- Non-significant: 0.6% treasury shares, including buy-backs in 2022 that will be cancelled in 2023. Once 16,658,366 shares are cancelled, the treasury shares will be non-significant and SAS Rue de La Boétie’s holding will account for about 57%.

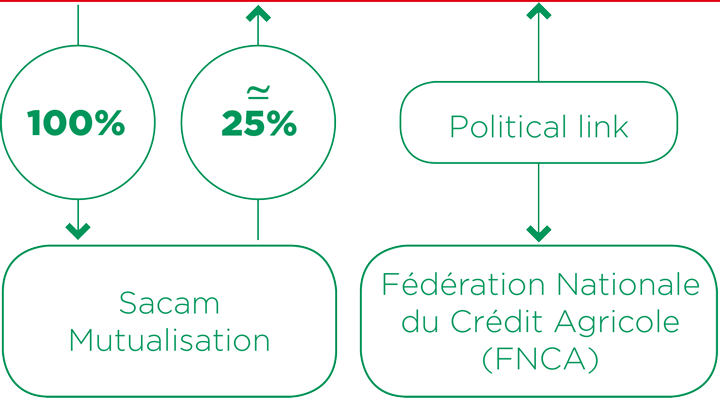

- The Regional Bank of Corsica, 99.9% owned by Crédit Agricole S.A., is a shareholder of SACAM Mutualisation.

- Excluding information made to the market by SAS Rue La Boétie, in November 2022, regarding its intention to purchase by the end of the first half year of 2023 Crédit Agricole S.A. shares on the market for a maximum amount of one billion euros.

- Disposal of Crédit du Maroc in December 2022.